1109 Equipment Lease

The University leases facilities and equipment as required by normal operations with the intention to support the mission of instruction, research and public service.

December 1986

revisedMay 2021

May 2025

Responsible OfficeTreasurer

Comptroller

Policy

The Office of the V.P. for Finance and Treasurer is responsible for classifying leases of equipment in the year of their origination as either operating or capital leases in accordance with the applicable financial accounting pronouncements.

Facilities and Real Estate Services (FRES) is responsible for classifying facility leases in the year of their origination as either operating or capital leases in accordance with the applicable financial accounting pronouncements.

FRES is responsible for the relationship with outside landlords acting as agent in the rental of third-party property and the payment of related rental expense

All leases or letters of agreement for rental of leased property must be executed by the Vice President of FRES.

The Office of the Comptroller is responsible for ensuring proper accounting for all leases during the life of the lease in accordance with the applicable financial accounting pronouncements.

- Generally, those standards provide that:

- Lease payments for leases classified as operating leases shall be monitored for materiality. Based on this materiality, the operating lease shall be:

- Recorded as an asset and a liability equal to the lesser of either the fair market value of the asset at the inception of the lease or the present value of the lease payments during the life of the lease. (material leases greater than 12 months in length).

- Straight-lined as an expenditure over the life of the lease (immaterial leases and/or leases less than 12 months in length).

- Lease payments for leases classified as operating leases shall be monitored for materiality. Based on this materiality, the operating lease shall be:

- Leases classified as capital leases shall be recorded as an asset and a liability equal to the lesser of either the fair market value of the asset at the inception of the lease or the present value of the lease payments during the life of the lease. The following policy elections shall be applied to ensure proper accounting for all leases in accordance with the applicable financial accounting pronouncements:

- Lease agreements in excess of $5,000 per unit and $250,000 in the aggregate shall be deemed material.

- Without readily determinable implicit rates, an incremental borrowing rate* shall be used to discount leases.

- For real estate leases, lease components (e.g. rental payments) and non-lease components (e.g. related maintenance services) shall be accounted for separately. For equipment leases, components of leases will not be separated and each lease component and non-lease component associated with that lease component will be accounted for as a single lease component.

- This policy pertains to leases with a minimum term in excess of 12 months.

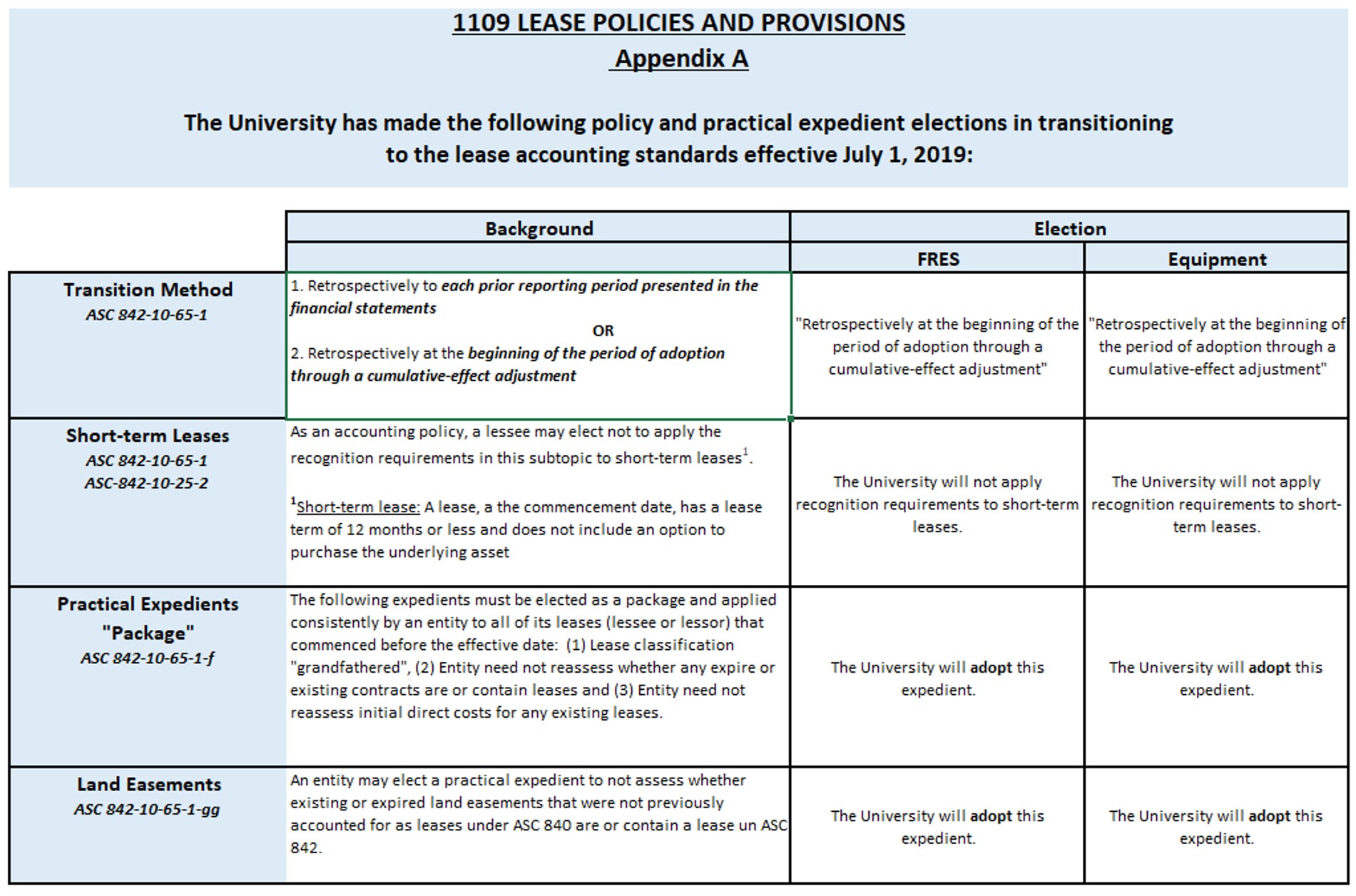

- The University has elected several policies and practical expedients in transitioning to accounting standards effective July 1, 2019. Refer to Appendix A below for a matrix detailing these elections.

*Effective July 1, 2019, the incremental borrowing rate used to discount the University’s leases will be sourced from the “High Quality Market (HQM) Corporate Bond Yield Curve” published monthly by the US Treasury.

- Generally, those standards provide that: